Maximize Return on Investment in your Commercial Property

Anthony A. Luna • July 26, 2024

Maximize Return on Investment in your Commercial Property

Investing in commercial property real estate can be highly profitable, but it requires careful planning and a strategic approach to maximize return on investment (ROI). Understanding the factors that influence commercial property ROI and implementing best practices can significantly enhance your profitability. This guide will delve into key strategies for achieving a high commercial property return on investment.

Understanding Commercial Property Real Estate ROI

Return on investment (ROI) is a key metric used to evaluate the profitability of an investment. In the context of commercial property real estate, ROI measures the return generated from the investment relative to its cost. It helps investors assess the efficiency and potential profitability of their investment.

ROI is typically expressed as a percentage and is calculated using the following formula:

Understanding ROI is crucial for making informed investment decisions and for comparing the performance of different properties.

Factors Influencing Commercial Property ROI

Several factors can influence the ROI of commercial property real estate. Understanding these factors can help investors make strategic decisions to maximize their returns.

Location

Location is one of the most critical factors in determining the ROI of a commercial property. Properties in prime locations with high foot traffic, easy accessibility, and proximity to amenities tend to have higher rental incomes and lower vacancy rates.

Property Type

The type of commercial property—such as office buildings, retail spaces, industrial properties, or multifamily units—affects the ROI. Different property types have varying demand levels, lease terms, and maintenance costs, all of which impact profitability.

Market Conditions

Economic conditions, interest rates, and local real estate market trends play a significant role in influencing commercial property ROI. A strong economy and a thriving real estate market generally lead to higher property values and rental incomes.

Tenant Quality

The quality of tenants can greatly affect the ROI of a commercial property. Reliable tenants who pay rent on time and maintain the property well can reduce vacancy rates and maintenance costs, leading to higher ROI.

Property Management

Effective property management is crucial for maximizing ROI. Professional property management can help in maintaining the property, addressing tenant concerns, and ensuring timely rent collection, thereby enhancing profitability.

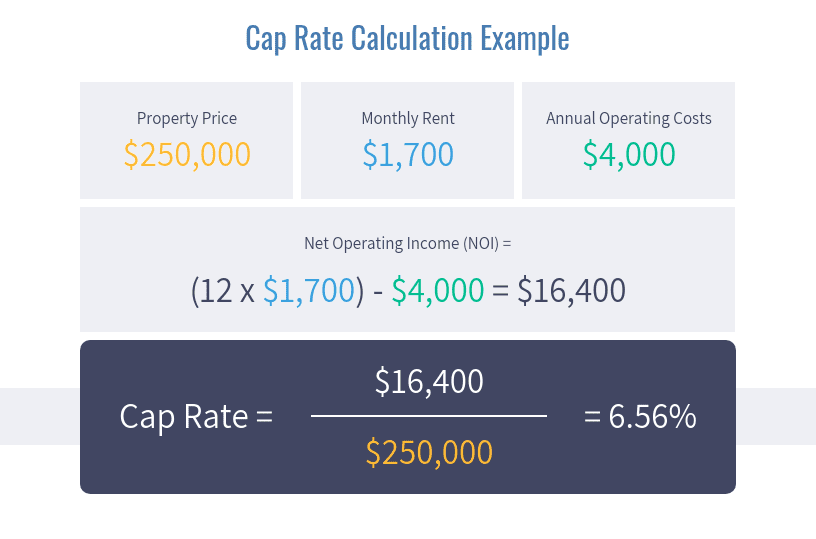

Calculating Commercial Real Estate ROI

Calculating the ROI for a commercial property involves determining the net profit generated by the property and dividing it by the total cost of the investment. Here's a step-by-step guide:

- Calculate Gross Income: This includes all income generated from the property, such as rental income, parking fees, and other revenue sources.

- Deduct Operating Expenses: Subtract all operating expenses, including maintenance costs, property management fees, insurance, property taxes, and utilities, to determine the Net Operating Income (NOI).

- Account for Financing Costs: Subtract any mortgage payments or financing costs from the NOI to determine the net profit.

- Determine Total Investment Cost: This includes the purchase price, closing costs, and any additional capital expenditures.

- Calculate ROI

Strategies to Maximize Commercial Property ROI

Implementing effective strategies can significantly boost the ROI of your commercial property investment. Here are some key strategies:

Conduct Thorough Market Research

Understanding the local real estate market is essential for making informed investment decisions. Conduct market research to identify high-demand areas, competitive rental rates, and emerging trends.

Improve Property Value

Invest in property improvements and upgrades to enhance its appeal and functionality. Upgraded properties can attract higher-quality tenants and command higher rental rates.

Negotiate Favorable Lease Terms

Negotiate lease terms that are favorable to your investment goals. Long-term leases with stable tenants provide consistent income, while flexible lease terms can attract a wider range of tenants.

Enhance Property Management

Effective property management ensures the property is well-maintained, tenant concerns are addressed promptly, and rent is collected on time. Consider hiring a professional property management company to maximize efficiency.

Monitor and Adapt to Market Trends

Stay informed about market trends and be ready to adapt your strategy accordingly. Changes in economic conditions, tenant preferences, and market demand can impact your ROI.

Common Pitfalls to Avoid

While investing in commercial property can be profitable, there are common pitfalls that investors should avoid:

- Overlooking Due Diligence: Failing to conduct thorough due diligence can lead to unforeseen problems and expenses.

- Ignoring Maintenance: Neglecting property maintenance can result in costly repairs and decreased property value.

- Overleveraging: Taking on too much debt can strain your finances and reduce your ROI.

- Not Having a Contingency Plan: Unexpected events can impact your investment. Have a contingency plan in place to address potential challenges.

Maximizing commercial property real estate return on investment requires a strategic approach and a thorough understanding of the factors that influence profitability. By conducting market research, improving property value, negotiating favorable lease terms, enhancing property management, and monitoring market trends, investors can achieve higher ROI. Avoiding common pitfalls and staying informed about market conditions are also crucial for long-term success in commercial real estate investments.

More about Coastline Equity

-

Property Management Services

Explore Our Services

Explore Our ServicesOur team will handle all your property needs, offering specialized services such as in-depth inspections, liability management, staff recruitment and training, and round-the-clock maintenance—expert support tailored to the unique requirements of your real estate assets.

-

About Us

.webp) Our Company

Our CompanyOur dedicated team transforms property management challenges into opportunities. From tenant management to streamlined rent collection and proactive maintenance.

-

Property Management Excellence

About Our CEO

About Our CEOAs a contributing author for Forbes, Anthony A. Luna brings a wealth of expertise and knowledge in the property management industry, real estate sector, and entrepreneurship, providing insights and thought-provoking analysis on a range of topics including property management, industry innovation, and leadership. Anthony has established himself as a leading voice in the business community. Through his contributions to Forbes, Anthony is set to publish his first book, 'Property Management Excellence' in April 2025 with Forbes Books.

-

Insights

Explore Our Blog

Explore Our BlogLearn more about Coastline Equity's property management practices & processes and how we support our clients with education and a growth mindset. Coastline Equity Property Management is your partner as you continue to learn and grow.

Property Management Made Easy

Los Angeles

Temecula

Free tools & Resources

Privacy policy

Service areas

- Aguanga Property Management

- Aliso Viejo Property Management

- Anaheim Hills Property Management

- Anaheim Property Management

- Anza Property Management

- Balboa Island Property Management

- Bellflower Property Management

- Belmont Shore Property Management

- Beverly Hills Property Management

- Bixby Knolls Property Management

- Bonsall Property Management

- Brea Property Management

- Burbank Property Management

- Carson Property Management

- Cerritos Property Management

- Costa Mesa Property Management

- Culver City Property Management

- Dana Point Property Management

- Downey Property Management

- East Costa Mesa Property Management

- El Segundo Property Management

- Fallbrook Property Management

- Fountain Valley Property Management

- French Valley Property Management

- Fullerton Property Management

- Garden Grove Property Management

- Gardena Property Management

- Glendale Property Management

- Harbor City Property Management

- Hawaiian Gardens Property Management

- Hemet Property Management

- Hermosa Beach Property Management

- Huntington Beach Property Management

- Inland Empire Property Management

- Irvine Property Management

- La Habra Property Management

- Ladera Ranch Property Management

- Laguna Beach Property Management

- Lake Elsinore Property Management

- Lakewood Property Management

- Lomita Property Management

- Long Beach Property Management

- Los Alamitos Property Management

- Manhattan Beach Property Management

- Marina del Rey Property Management

- Menifee Property Management

- Mission Viejo Property Management

- Murrieta Hot Springs Property Management

- Naples Property Management

- Newport Beach Property Management

- North Tustin Property Management

- Old Torrance Property Management

- Orange County Property Management

- Palos Verdes Drive East Property Management

- Paramount Property Management

- Pasadena Property Management

- Perris Property Management

- Placentia Property Management

- Rancho Palos Verdes Property Management

- Redondo Beach Property Management

- Riverside County Property Management

- Rolling Hills Property Management

- Rossmoor Property Management

- San Bernardino County Property Management

- Santa Ana Property Management

- Seal Beach Property Management

- Signal Hill Property Management

- Silverlake Property Management

- Temecula Property Management

- Torrance Property Management

- Tustin Property Management

- Venice Property Management

- West Hollywood Property Management

- Westminster Property Management

- Whittier Property Management

- Wildomar Property Management

- Wilmington Property Management

- Winchester Property Management

- Yorba Linda Property Management

- Property Management Near Me

- San Pedro Property Management

- Los Angeles Property Management