RUBS vs. Submetering: Which Utility Billing Method Is Best for Your Rental Property?

If you own a multifamily property, figuring out how to fairly bill tenants for utilities can be a real challenge. Should you install individual meters for each unit? Or is there a more flexible, cost-effective option?

Many property owners and real estate investors are turning to utility billing systems like the Ratio Utility Billing System (RUBS) as an alternative to submetering. But which method is best for your rental property?

Let’s break it down so you can decide with confidence.

What Is RUBS?

RUBS, or Ratio Utility Billing System, is a method of allocating utility costs to tenants based on specific factors — such as number of occupants, square footage, or number of bedrooms — instead of actual usage.

Instead of installing an individual meter for each unit, the landlord uses a RUBS formula to divide the total utility cost among the tenants. This makes it ideal for older buildings or properties where retrofitting for submeters isn’t practical or cost-effective.

What Is Submetering?

Submetering, on the other hand, means installing an individual utility meter for each unit. Tenants are then billed based on their actual utility usage — just like a single-family homeowner would be.

This method provides the most accurate picture of utility consumption, but it also comes with higher installation and maintenance costs.

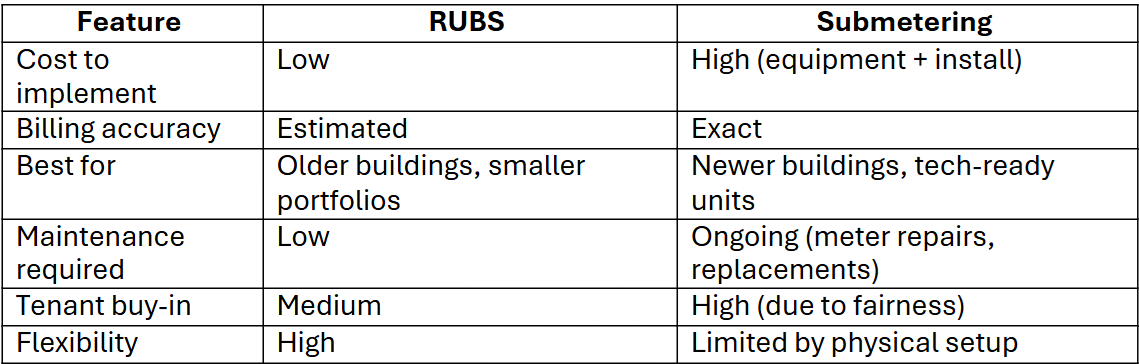

Comparing RUBS and Submetering

When choosing between RUBS and submetering, consider the following:

- Property age and layout: If you own a vintage or mixed-use building, implementing a Ratio Utility Billing System (RUBS) may be much easier than adding submeters.

- Number of units and size: For properties with larger units or a wide range of unit types, RUBS allows billing based on factors like occupancy or size.

- Tenant turnover: Frequent move-ins and move-outs? RUBS simplifies the billing process and makes utility recovery more consistent.

- Compliance and legal considerations: Check state and local laws to confirm whether RUBS programs are permitted in your area.

Benefits of RUBS

RUBS programs offer several advantages for property owners:

- Helps recover utility costs without the high expense of meters

- Allows you to manage utilities more efficiently

- Encourages tenants to reduce utility consumption, even without individual meters

- Simplifying billing makes it easier to manage cash flow and reduce utility-related losses

It’s especially useful for owners of multifamily properties who want more control over cost recovery without investing in infrastructure upgrades.

When Submetering Might Make More Sense

If your property is newer, already has individual meters, or your tenants demand precision and transparency, submetering may be the better fit. Some tenants prefer paying for their exact utility usage, especially in competitive rental markets.

Also, submetering may yield stronger long-term tenant satisfaction in certain communities.

Final Thoughts

Both RUBS and submetering are valid utility billing systems — the right one for your property depends on your goals, building type, and budget.

If you’re looking for a scalable solution that simplifies the billing process, improves cost recovery, and doesn’t require invasive installations, RUBS may be the ideal fit. On the other hand, if your focus is precise billing tied to individual consumption, submetering offers a direct path.

Not sure which is best for your property? Start with a utility audit and evaluate the pros and cons based on your building’s layout, resident demographics, and local regulations.

More about Coastline Equity

Property Management Services

Learn More

Learn MoreOur team will handle all your property needs, offering specialized services such as in-depth inspections, liability management, staff recruitment and training, and round-the-clock maintenance—expert support tailored to the unique requirements of your real estate assets.

About Us

Learn More

Learn MoreOur dedicated team transforms property management challenges into opportunities. From tenant management to streamlined rent collection and proactive maintenance.

Property Management Excellence

Learn More

Learn MoreAs a contributing author for Forbes, Anthony A. Luna brings a wealth of expertise and knowledge in the property management industry, real estate sector, and entrepreneurship, providing insights and thought-provoking analysis on a range of topics including property management, industry innovation, and leadership.

Anthony has established himself as a leading voice in the business community. Through his contributions to Forbes, Anthony is set to publish his first book, "Property Management Excellence" in April 2025 with Forbes Books.

Insights

Learn More

Learn MoreLearn more about Coastline Equity's property management practices & processes and how we support our clients with education and a growth mindset.

Coastline Equity Property Management is your partner as you continue to learn and grow.

News & Updates

Property Management Made Easy

Los Angeles

1411 W. 190th St.,

Suite 225

Los Angeles, CA 90248

Temecula

41743 Enterprise Circle N.,

Suite 207

Temecula, CA 92590

P.O. BOX #1489

TORRANCE, CA 90505