What Does NNN Mean in Commercial Lease Agreements?

If you’re a commercial property owner or real estate investor, one of the most important decisions you'll make when structuring a lease is whether or not to offer an NNN lease. But what does “NNN” actually mean in a commercial lease agreement — and how does it impact your income, responsibilities, and your tenants?

Let’s break it down so you can make informed leasing decisions that benefit both you and your tenants.

What Is an NNN Lease?

An NNN lease, short for Triple Net lease, is a type of net lease where the tenant is responsible for paying three major cost categories in addition to the base rent:

- Property taxes

- Insurance

- Operating expenses (including common area maintenance)

These costs are typically passed through to the tenant, making this structure attractive to owners who want to reduce their hands-on property management involvement.

Why Commercial Owners Choose NNN Leases

For owners of an office building, retail center, or other commercial space, an NNN lease can:

- Simplify cash flow

- Minimize unpredictable operating costs

- Shift maintenance responsibility to tenants

- Increase the long-term value of the investment

Because the tenant is responsible for expenses, your monthly rent collections become more consistent and less vulnerable to rising property taxes and insurance costs.

What the Tenant Pays For in an NNN Lease

Under an NNN lease, the tenant is responsible for:

- Base rent (usually lower than gross rent)

- Property taxes and insurance

- Common area upkeep (landscaping, janitorial, lighting, etc.)

- Utilities and interior maintenance for their own space

This means the tenant’s total monthly rent is calculated as:

Base Rent + (Share of Property Taxes, Insurance, and CAM/Operating Costs)

These amounts are often divided by the square foot they lease. For example, if your building has 20,000 square feet and the tenant occupies 4,000, they would cover 20% of the shared expenses.

NNN vs. Other Lease Structures

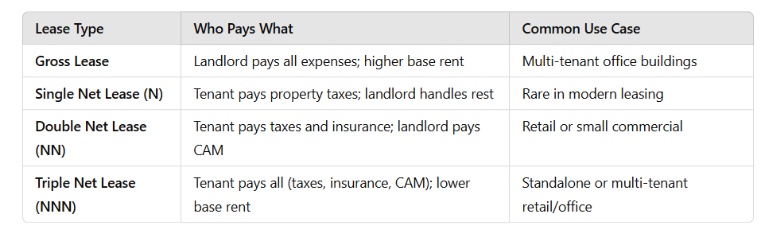

Let’s look at how NNN leases compare to other commercial lease types:

These leases typically shift more financial responsibility to the tenant as you move from gross leases toward net leases.

Responsibilities for Landlords and Tenants

In an NNN lease, landlords and tenants share very different roles:

Landlord Responsibilities:

- Maintain structural integrity of the building (roof, foundation, etc.)

- Negotiate service contracts for shared areas (if needed)

- Enforce lease terms and ensure compliance

Tenant Responsibilities:

- Pay base rent and pass-through costs

- Handle interior repairs and maintenance

- Keep up with their portion of

operating expenses

More about Coastline Equity

Property Management Services

Learn More

Learn MoreOur team will handle all your property needs, offering specialized services such as in-depth inspections, liability management, staff recruitment and training, and round-the-clock maintenance—expert support tailored to the unique requirements of your real estate assets.

About Us

Learn More

Learn MoreOur dedicated team transforms property management challenges into opportunities. From tenant management to streamlined rent collection and proactive maintenance.

Property Management Excellence

Learn More

Learn MoreAs a contributing author for Forbes, Anthony A. Luna brings a wealth of expertise and knowledge in the property management industry, real estate sector, and entrepreneurship, providing insights and thought-provoking analysis on a range of topics including property management, industry innovation, and leadership.

Anthony has established himself as a leading voice in the business community. Through his contributions to Forbes, Anthony is set to publish his first book, "Property Management Excellence" in April 2025 with Forbes Books.

Insights

Learn More

Learn MoreLearn more about Coastline Equity's property management practices & processes and how we support our clients with education and a growth mindset.

Coastline Equity Property Management is your partner as you continue to learn and grow.

News & Updates

Property Management Made Easy

Los Angeles

1411 W. 190th St.,

Suite 225

Los Angeles, CA 90248

Temecula

41743 Enterprise Circle N.,

Suite 207

Temecula, CA 92590

P.O. BOX #1489

TORRANCE, CA 90505